Montage Gold Corp. More Than Doubles Footprint at Koné Gold Project and Drills 8m at 3.15g/t Au 8km East of Koné

September 8, 2021

Vancouver, British Columbia — September 8, 2021 — Montage Gold Corp. (“Montage” or the “Company”) (TSXV: MAU) (OTCPK: MAUTF) is pleased to report that the Company has received, by Presidential decree, a new exploration license sitting within trucking distance of the Koné deposit, and which now forms part of the Koné Gold Project (“KGP”) in Côte d’Ivoire. The Company is also pleased to report high-grade drill results from the Petit Yao Central target and an update on its strategy for district exploration.

Hugh Stuart, Montage CEO commented, “With this new exploration license (“Faradougou”) we are more than doubling our exploration footprint at the KGP and can explore nearly 700km2 of prospective ground. Faradougou sits due north of the Koné exploration license, is split by the asphalt road that goes past the Koné deposit and has no recorded history of modern exploration.

“With infill drilling at the Koné deposit now complete and a 4.27Moz Indicated Mineral Resource (at 0.20g/t cut-off grade) delivered into the Feasibility Study program, the focus of the geological team is shifting to district exploration, targeting satellite deposits that can expand resources at the KGP. Given the potential for a large-scale, low-cost operation at the KGP, the value-add of satellite mineralization to the project is significant.

“Follow-up drilling at the Petit Yao Central target is encouraging and is showing potential as the first possible satellite pit sitting just 8km east of the Koné deposit. We look forward to the next round of exploration in the Petit Yao area, as well as initial testing within the Faradougou exploration license.”

HIGHLIGHTS

- New Exploration License awarded by Government of Côte d’Ivoire.

- Faradougou covers 361.5km2 of unexplored ground within trucking distance of the Koné deposit

- Initial soil sampling program planned to start immediately

- High-grade drill results from follow-up program at Petit Yao Central include:

- MPYRC015: 6m grading 2.91g/t Au from 5m

- MPYRC018: 8m grading 3.15g/t Au from 52m

- Petit Yao Central showing potential as first satellite deposit target.

- Shallow dipping oxide mineralization in the range of 2g/t Au

- 8km east of the Koné deposit within the Koné exploration license

- Soil sampling shows potential 20km greenstone trend for further testing

- Exploration planned for Q4 2021 across entire Montage portfolio.

- District exploration at KGP, including Faradougou and Petit Yao

- Exploration at Korokaha and Bobosso projects

- Fully funded for current programs as well as completion of Feasibility Study.

DETAILS

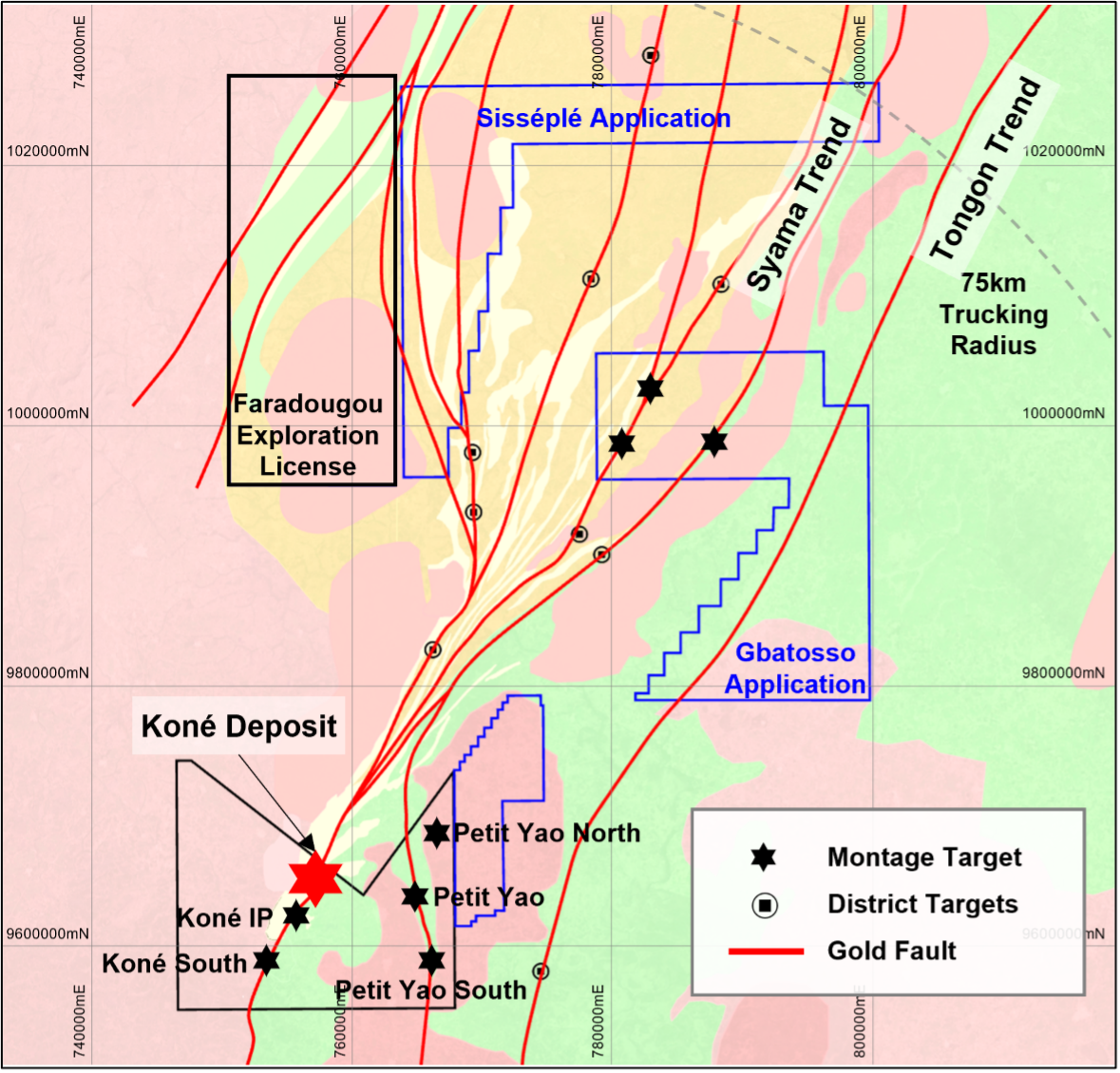

Faradougou Exploration License

The Company was awarded by Presidential decree, the permis de recherche (PR748) referred to as the Faradougou Exploration License. The license includes an initial term of four years with up to two renewals, for a total potential term of nine years. There are no records of historic exploration on this license, and it carries no private third-party royalties.

The southern most border of Faradougou sits approximately 30km due north of the Koné deposit and the entire license sits within trucking distance to the planned processing facility at the KGP.

Figure 1: Exploration Licenses and Applications of the Koné Gold Project

Initial exploration plans for Faradougou include screening with soil geochemistry and detailed geological mapping with work expected to commence in the next two weeks. Like the area around Koné, there is minimal habitation, and the proximity of the main road would make mining and transport of material from satellite pits straightforward.

Petit Yao Exploration Results

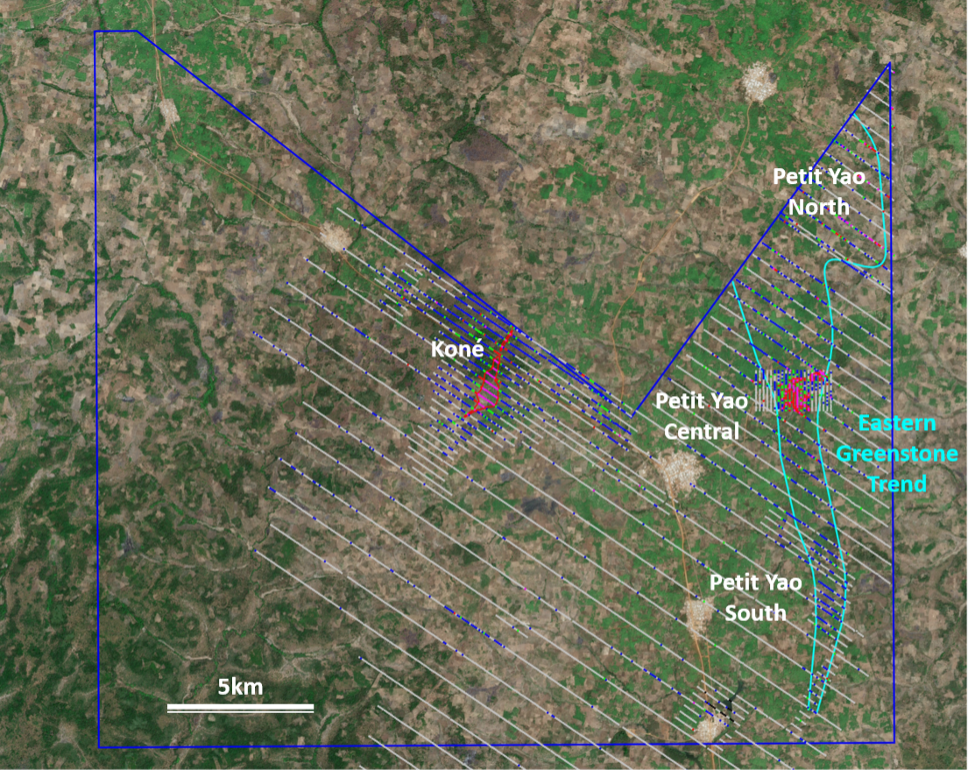

The Petit Yao area sits approximately 8km east of the Koné deposit (Figure 2) and was first identified in late 2019 by Montage geologists after recognizing prospective volcanic rocks in an area previously assumed to be un-prospective basement rocks, which hosted several large depressions indicative of historic artisanal mining.

Infill soil sampling and reassessment of earlier data suggests that Petit Yao sits within a wider north-south trending belt of prospective greenstone geology and further infill sampling and geological mapping is now in progress in the northern extent of this area.

There are now three targets within the broader Petit Yao area to be explored: Petit Yao Central, Petit Yao North, and Petit Yao South.

Figure 2: Koné Exploration License with Petit Yao Target Areas Highlighted

Petit Yao Central (Figure 3) was the first target tested with deeper RC drilling following 4,730m of shallow air core drilling completed in 2020. The 1,830m of RC drilling completed in 2021 has clarified the presence of a shallow dipping zone of mineralization generally grading over 2g/t Au (Figures 4 and 5), over a strike length of more than 300m, in places associated with a lithological contact between mafic volcanics and a diorite intrusive.

Figure 3: Petit Yao Central Drill Map and Interpretation (Plan View)

Figure 4: Petit Yao Central Section 1 (Looking North)

Figure 5: Petit Yao Central Section 2 (Looking West))

These results, whilst still very early, are encouraging and represent only the second anomaly identified at the KGP. With solid grade sitting in oxide (expected high gold recoveries) and a shallow dip, this target justifies further work and another phase of drilling is being planned.

The key is that with the large-scale, low-cost operation being envisaged at the KGP, exploration no longer needs to find a standalone resource. Discoveries of satellites as small as 50–100koz that can be trucked to Koné can have a significant impact on the economics of the project.

Complete drill data from Petit Yao Central is included as Appendix A of this release.

ABOUT MONTAGE GOLD CORP.

Montage is a Canadian-based precious metals exploration and development company focused on opportunities in Côte d’Ivoire. The Company’s flagship property is the Koné Gold Project, located in northwest Côte d’Ivoire, which currently hosts an Indicated Mineral Resource of 225Mt grading 0.59g/t for 4.27Moz of gold, based on a 0.20g/t cut-off grade and an Inferred Mineral Resource of 22Mt grading 0.45g/t for 0.32Moz of gold, based on a 0.20g/t cut-off grade. Montage has a management team and Board with significant experience in discovering and developing gold deposits in Africa. The Company is rapidly progressing work programs at the Koné Gold Project towards completion of a Feasibility Study by the end of 2021.

QUALIFIED PERSONS STATEMENT

The technical contents of this release have been approved by Hugh Stuart, BSc, MSc, a Qualified Person pursuant to National Instrument 43-101. Mr. Stuart is the Chief Executive Officer of the Company, a Chartered Geologist and a Fellow of the Geological Society of London. Samples used for the results described herein have been prepared and analyzed by fire assay using a 50-gram charge at the Bureau Veritas facility in Abidjan, Côte d’Ivoire and at Intertek in Tarkwa Ghana. Field duplicate samples are taken and blanks and standards are added to every batch submitted.

CONTACT INFORMATION

Hugh Stuart

Chief Executive Officer

hstuart@montagegoldcorp.com

Adam Spencer

Executive Vice President, Corporate Development

aspencer@montagegoldcorp.com

mobile: +1 (416) 804-9032

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS

This press release contains certain forward-looking information and forward-looking statements within the meaning of Canadian securities legislation (collectively, “Forward-looking Statements”). All statements, other than statements of historical fact, constitute Forward-looking Statements. Words such as “will”, “intends”, “proposed” and “expects” or similar expressions are intended to identify Forward-looking Statements. Forward looking Statements in this press release include statements related to the Company’s resource properties, and the Company’s plans, focus and objectives. Forward-looking Statements involve various risks and uncertainties and are based on certain factors and assumptions. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include uncertainties related to fluctuations in gold and other commodity prices, uncertainties inherent in the exploration of mineral properties, the impact and progression of the COVID-19 pandemic and other risk factors set forth in the Company’s final prospectus under the heading “Risk Factors”. The Company undertakes no obligation to update or revise any Forward-looking Statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Montage to predict all of them, or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any Forward-looking Statement. Any Forward-looking Statements contained in this press release are expressly qualified in their entirety by this cautionary statement.

APPENDIX 1: Drill Results from Petit Yao Central Completed to Date

Note:

Intercepts are 80-100% of true width

* Denotes previously released drill results

Grid: WGS84 UTM Zone 29N

| Hole | Collar Location | Orientation | Depth | Down-hole Intercept (m) | Grade Au g/t |

|||||

| mE | mN | mRL | Azim | Dip | From | To | Metres | |||

| MPYRC001 | 765,382 | 964,249 | 345 | 310 | -55 | 45 | No Significant Intercept | |||

| MPYRC002 | 765,393 | 964,241 | 345 | 310 | -54 | 60 | No Significant Intercept | |||

| MPYRC003 | 765,371 | 964,216 | 343 | 310 | -55 | 72 | 6 | 20 | 14 | 0.80 |

| MPYRC004 | 765,385 | 964,227 | 345 | 310 | -55 | 84 | No Significant Intercept | |||

| MPYRC005 | 765,097 | 964,654 | 351 | 360 | -53 | 50 | No Significant Intercept | |||

| MPYRC006 | 765,099 | 964,632 | 351 | 0 | -56 | 112 | No Significant Intercept | |||

| MPYRC007 | 765,063 | 964,655 | 352 | 0 | -55 | 50 | No Significant Intercept | |||

| MPYRC008 | 765,063 | 964,632 | 351 | 0 | -55 | 100 | No Significant Intercept | |||

| MPYRC009 | 765,000 | 964,598 | 355 | 0 | -54 | 90 | 47 | 59 | 12 | 1.45 |

| MPYRC010 | 765,021 | 964,593 | 351 | 360 | -56 | 84 | No Significant Intercept | |||

| MPYRC011 | 764,961 | 964,662 | 355 | 360 | -56 | 66 | No Significant Intercept | |||

| MPYRC012 | 764,962 | 964,648 | 355 | 360 | -56 | 78 | No Significant Intercept | |||

| MPYRC013 | 764,980 | 964,685 | 355 | 30 | -55 | 114 | No Significant Intercept | |||

| MPYRC014 | 764,981 | 964,664 | 354 | 360 | -57 | 50 | 22 | 38 | 16 | 0.91 |

| MPYRC015 | 764,960 | 964,713 | 356 | 35 | -57 | 100 | 5 | 11 | 6 | 2.91 |

| MPYRC016 | 764,950 | 964,728 | 356 | 40 | -56 | 60 | No Significant Intercept | |||

| MPYRC017 | 764,929 | 964,714 | 356 | 250 | -55 | 64 | 51 | 60 | 9 | 1.74 |

| MPYRC018 | 764,928 | 964,700 | 356 | 270 | -58 | 78 | 52 | 60 | 8 | 3.15 |

| MPYRC019 | 764,926 | 964,689 | 356 | 360 | -57 | 60 | 35 | 40 | 5 | 0.80 |

| MPYRC020 | 764,966 | 964,769 | 358 | 248 | -56 | 78 | No Significant Intercept | |||

| MPYRC021 | 764,943 | 964,788 | 357 | 250 | -56 | 59 | 3 | 10 | 7 | 1.20 |

| MPYRC022 | 764,944 | 964,775 | 359 | 250 | -57 | 66 | 7 | 14 | 7 | 1.34 |

| MPYRC023 | 765,039 | 964,595 | 351 | 355 | -56 | 90 | 41 | 52 | 11 | 0.61 |

| MPYRC024 | 765,064 | 964,596 | 350 | 356 | -56 | 96 | No Significant Intercept | |||

| MRCAC116* | 765,002 | 964,650 | 352 | 332 | -55 | 48 | 22 | 27 | 5 | 3.73 |

| 31 | 34 | 3 | 0.74 | |||||||

| MRCAC117* | 765,019 | 964,655 | 353 | 332 | -55 | 49 | 20 | 28 | 8 | 2.06 |

| MRCAC118* | 765,036 | 964,656 | 353 | 320 | -55 | 48 | 15 | 30 | 15 | 1.71 |

| MRCAC119* | 764,980 | 964,646 | 352 | 330 | -55 | 46 | 31 | 34 | 3 | 1.09 |

| 39 | 46 | 7 | 0.87 | |||||||

| MRCAC125* | 764,937 | 964,701 | 355 | 325 | -50 | 39 | 29 | 35 | 6 | 1.81 |

| MRCAC128* | 764,949 | 964,751 | 356 | 325 | -50 | 40 | 0 | 12 | 12 | 4.15 |

| MRCAC130* | 764,942 | 964,804 | 358 | 325 | -50 | 40 | 0 | 7 | 7 | 0.95 |

| MRCAC132* | 764,941 | 964,851 | 361 | 325 | -50 | 40 | 0 | 7 | 7 | 1.04 |

| MRCAC135* | 765,037 | 964,631 | 352 | 325 | -50 | 40 | 29 | 38 | 9 | 2.46 |

| MRCAC147* | 765,043 | 964,957 | 364 | 325 | -50 | 40 | 8 | 16 | 8 | 1.23 |

| MRCAC182* | 765,443 | 964,139 | 348 | 325 | -50 | 40 | 28 | 34 | 6 | 0.67 |

| MRCAC185* | 765,370 | 964,234 | 344 | 290 | -50 | 40 | 0 | 19 | 19 | 0.78 |

| MRCAC208* | 765,143 | 964,557 | 346 | 325 | -55 | 50 | 36 | 48 | 12 | 0.71 |

| MRCAC212* | 765,282 | 964,473 | 344 | 235 | -55 | 41 | 12 | 18 | 6 | 3.68 |

| MRCAC213* | 765,260 | 964,472 | 344 | 235 | -55 | 42 | 12 | 18 | 6 | 1.42 |

| MRCAC220* | 765,118 | 964,473 | 343 | 235 | -55 | 38 | 0 | 6 | 6 | 0.84 |