Montage Increases Inferred Mineral Resource at Koné Deposit to 3.16Moz

January 28, 2021

Vancouver, British Columbia — January 28, 2020 — Montage Gold Corp. (“Montage” or the “Company”) (TSXV:MAU) is pleased to report an updated Inferred Mineral Resource estimate for the Koné deposit, at the Morondo Gold Project (“MGP”) in Côte d’Ivoire and to provide an update of the ongoing Preliminary Economic Assessment (“PEA”).

Hugh Stuart, CEO and Director of Montage commented, “The completion of the updated Inferred Mineral Resource at Koné sets the stage for the completion and delivery of the PEA, which the Company is confident will demonstrate the potential and scope of this exciting project.

“With an Inferred Mineral Resource of more than 3Moz grading 0.80g/t Koné has taken a major step forward in terms of scale. The Koné deposit shares many attributes with a porphyry gold deposit that can drive robust production and economics as part of a large-scale mining and processing operation.

“The Koné Inferred Mineral Resource estimate includes a higher-grade component of over 2Moz grading 1.1g/t. This higher-grade mineralization is expected to give the Company flexibility with respect to processing at an elevated cut-off grade in the early years of the mine, thereby maximizing project economics. The simplicity of the project, the potential for large scale mining at low unit costs, solid metallurgy and access to grid power are all combining towards the development of a solid economic project that has excellent exploration upside; Koné is the first anomaly within Montage’s 1,442km2 MGP land package to receive any significant drilling.”

HIGHLIGHTS

- Inferred Mineral Resource estimate comprises 123Mt grading 0.80g/t for 3.16Moz of gold at a 0.40g/t cut-off grade.

- The estimate includes a higher-grade component of 57.5mt grading 1.1g/t for 2.03Moz of gold at a 0.70g/t cut-off grade.

- Koné remains open along strike and at depth.

- 35,000m drill program underway targeting further growth in resources and an upgrade to the Indicated category

- The Inferred Mineral Resource and preliminary results from aspects of the PEA demonstrate positive attributes of the Koné deposit.

- Geotechnical study provides for steeper pit walls with the potential to reduce strip ratio

- Comminution study confirms initial testing

- Hydrology study confirms minimal pit water inflows and sufficient water supply for process plant

- Metallurgical recovery test work nearing completion and is confirming initial testing

DETAILS

Updated Inferred Mineral Resource Estimate

The updated Inferred Mineral Resource estimate was undertaken by MPR Geological Consultants of Perth, Australia (“MPR”) who estimated recoverable mineral resources using Multiple Indicator Kriging (“MIK”). A total of 22,528m of drilling (7,901m of RC and 14,627m of diamond core) has been completed in the Koné resource area since the October 2018 Inferred Mineral Resource estimate giving a total of 40,540m (25,385m of RC and 15,155m of core) on which this new estimate has been based.

The updated Inferred Mineral Resource estimate is reported within an optimal pit shell based on a US$1,500/oz gold price and is shown below at a range of cut-off grades.

| Cut-off Grade | Inferred Mineral Resources (January 2021) | ||

|---|---|---|---|

| Au g/t | Mt | Au g/t | Au Moz |

| 0.2 | 211 | 0.59 | 4.00 |

| 0.3 | 161 | 0.69 | 3.57 |

| 0.4 | 123 | 0.80 | 3.16 |

| 0.5 | 95.6 | 0.90 | 2.77 |

| 0.6 | 74.1 | 1.0 | 2.38 |

| 0.7 | 57.5 | 1.1 | 2.03 |

| 0.8 | 44.7 | 1.2 | 1.72 |

Table 1: Inferred Mineral Resource Estimate by Cut-off Grade

Notes

- Inferred Mineral Resources are reported in accordance with NI 43-101 with an effective date of January 27, 2021, for the Koné deposit within the Morondo Gold Project.

- The Inferred Mineral Resources are reported on a 100% basis and are constrained within an optimal pit shell generated at a gold price of US$1,500/ounce.

- The identified Mineral Resources are classified according to the “CIM” definitions of Inferred Mineral Resources.

- The Inferred Mineral Resource statement was prepared by Mr. Jonathon Abbott of MPR Geological Consultants of Perth, Australia who is a Qualified Person as defined by NI 43-101.

- The estimates at 0.4g/t cut-off grade represent the base case or preferred scenario.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The Company will file an NI 43-101 Technical Report on the updated Inferred Mineral Resource estimate within 45 days of this release.

Table 2 (below) shows the growth in estimated contained gold for the Koné deposit across a range of cut-off grades. The Inferred Mineral Resource estimate for the Koné deposit has grown 73% at a 0.70g/t cut-off and 85% at a 0.40g/t cut-off relative to the resources reported in October 2020, which were derived from the October 2018 resource model.

| Cut-off Grade | Inferred Mineral Resource as Reported October 20201 | Inferred Mineral Resources (January 2021) | Change | |||||

|---|---|---|---|---|---|---|---|---|

| Au g/t | Mt | Au g/t | Au Moz | Mt | Au g/t | Au Moz | Au Moz | % |

| 0.2 | 92.9 | 0.66 | 1.97 | 211 | 0.59 | 4.00 | 2.03 | 103% |

| 0.3 | 77.7 | 0.74 | 1.85 | 161 | 0.69 | 3.57 | 1.72 | 93% |

| 0.4 | 64.1 | 0.83 | 1.71 | 123 | 0.80 | 3.16 | 1.45 | 85% |

| 0.5 | 52.5 | 0.91 | 1.54 | 95.6 | 0.90 | 2.77 | 1.23 | 80% |

| 0.6 | 42.2 | 1.0 | 1.36 | 74.1 | 1.0 | 2.38 | 1.03 | 76% |

| 0.7 | 33.3 | 1.1 | 1.18 | 57.5 | 1.1 | 2.03 | 0.86 | 73% |

| 0.8 | 26.0 | 1.2 | 1.00 | 44.7 | 1.2 | 1.72 | 0.72 | 72% |

Table 2: Growth of Inferred Mineral Resource Estimate

1. Refer to SEDAR for October 2020 NI 43-101 Technical Report entitled “Amended and Restated Technical Report for the Morondo Gold Project, Côte d’Ivoire”.

• See table 1 Notes

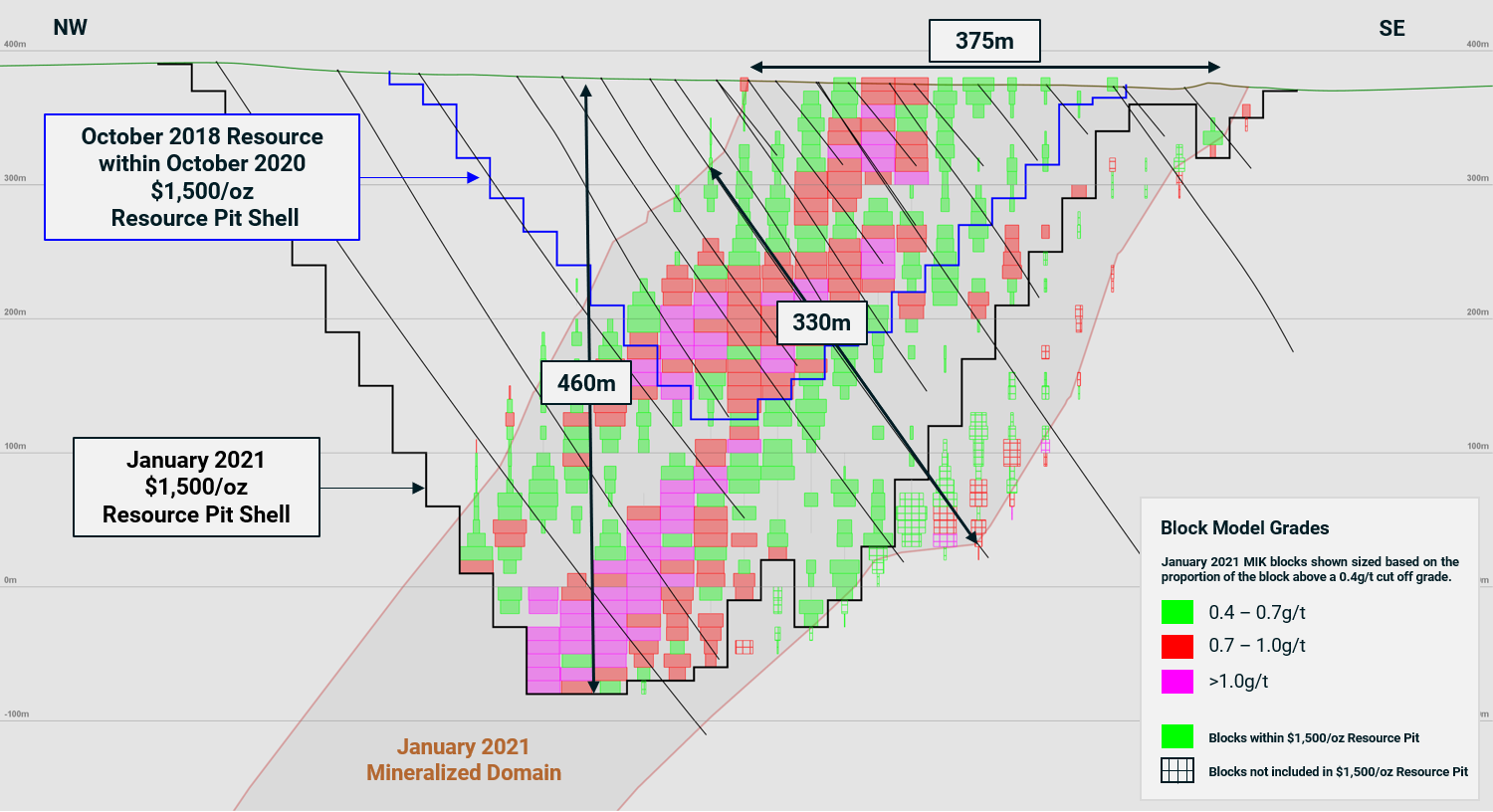

Figure 1 shows a typical cross-section through the Koné deposit and demonstrates the scale and geometry of the mineralization. The US$1,500/oz shell within which the updated Inferred Mineral Resource is reported is restricted from going deeper by the lack of drilling, as shown in the cross-section below. Montage is planning deeper drilling to test mineralization below the current estimates and the Company is optimistic of additional resource growth from this program.

Figure 1: Koné Deposit Cross-Section

When visualized in 3D (see Figure 2), the scale and continuity of the Koné deposit becomes apparent. Mineralization at the Koné deposit has been defined over 2.35km of strike and to depths up to 475m below surface and remains open.

Within the main part of the deposit, true mineralized widths are up to 350m with horizonal widths up to 450m at surface. The significant mineralized widths at potential mining cut-offs provide the opportunity to use large scale bulk mining methods and thereby reduce mining unit costs.

Figure 2: Resource Block Model with $1,500/oz Resource Pit Shell

PEA Update

The PEA is progressing well and remains on track for completion in late Q1 and the Company expects to release results in early April 2021. A summary of results from various test work programs and studies is presented below.

Geotechnical Study — Now Complete

Seven geotechnical core holes (1,752m) were completed and SRK has delivered their report. The report confirms that the rock mass to be mined within the pit is strong, competent and homogenous and will therefore allow a steepening of pit slope angles in comparison to previous estimates. For the purpose of the PEA pit optimization the following maximum overall slope angles have now been recommended:

- Oxide Zone — (Surface to +/- 35 m depth): 36°

- Transition Zone — (+/-35 m to +/- 60 m depth): 65°

- Fresh Zone — (+/- 60 m depth and below): 59° (Hanging wall), 60° (Foot wall and end walls).

Utilizing this combination of slope angles results in an overall pit slope, from surface to pit bottom, of approximately 55°. This is a significant increase over prior assumptions of 45° slope angles and is expected to reduce the projected strip ratio.

Mining Study — 40% Complete

Following receipt of the updated Inferred Mineral Resource estimate, work has commenced on the pit optimizations that will be used for open pit mine design and mining scheduling. For the purpose of the mining study a gold price of US$1,200/oz will be used.

The Koné Mineral Resource estimate includes 57.5Mt at a higher grade of 1.1g/t for 2.03Moz (using a 0.70g/t cut-off grade) within the wider, lower grade mineralized domain. Mine scheduling is evaluating mining at an elevated cut off grade with stockpiling of lower grade material in the early years of the mine life to maximize grade in those early years.

Hydrology Study — Now Complete

No issues have been identified in the hydrology study with low in pit water inflows expected. Knight Piesold has confirmed the availability of sufficient water supply for the project.

Metallurgical Study — 85% Complete

Comminution tests have been completed on 40 variability core samples from Koné. The test work has confirmed the amenability of the mineralized material to processing with lower power requirements resulting in lower unit costs.

Leach optimization test work has determined that optimal conditions were obtained through a standard CIL circuit with a target grind of 75µm and 36-hour residence time.

Variability leach test work is nearing completion on 39 samples, which will provide recovery and reagent consumptions by oxidation state. Preliminary data suggests that gold recoveries are similar to the initial 2018 test work (91.4% recovery in fresh rock).

The Company will provide a further update upon completion of the variability leach test work.

Engineering — 50% Complete

Lycopodium is well advanced with process plant design and costing having received the bulk of required parameters from the metallurgical study. The plant will be based on a simple flowsheet comprising single stage crushing, a SAG and ball mill, followed by a leaching circuit.

Tailings Storage Facility — 50% Complete

Knight Piesold have completed a first draft of the tailings and water storage facility designs which are now being refined.

Environmental — 20% Complete

The main phase of the Environment and Social Impact Assessment (ESIA) will commence in the next month with the mobilization of consultants to site. The study will progress through the completion of the PEA and into the Feasibility Study review with completion expected by the end of 2021.

Operating Under Budget — Business Plan Fully Funded for 2021

Montage remains fully funded for its business plan through 2021. This includes: a phase 2 drilling program (35,000m); release of PEA results in early April 2021; an Indicated Mineral Resource estimate by the end of Q2 2021; and a Feasibility Study by the end of 2021.

As of December 31, 2020, Montage had a cash balance of approximately C$33 million.

CONTACT INFORMATION

Hugh Stuart

Chief Executive Officer

hstuart@montagegoldcorp.com

Adam Spencer

Executive Vice President, Corporate Development

aspencer@montagegoldcorp.com

mobile: +1 (416) 804-9032

ABOUT MONTAGE GOLD CORP.

Montage Gold Corp. (TSXV:MAU) is a Canadian-based precious metals exploration and development company focused on opportunities in Côte d’Ivoire. The Company’s flagship property is the Morondo Gold Project, located in northwest Côte d’Ivoire. Montage has a management team and board with significant experience in discovering and developing gold deposits in Africa. The Company is rapidly progressing work programs at the Morondo Gold Project towards completion of a Feasibility Study by the end of 2021.

MINERAL RESOURCE MODELING AND ESTIMATION ASSUMPTIONS

Recoverable resources were estimated for the Koné deposit by Multiple Indicator Kriging (“MIK”) of two metre down-hole composited gold grades from RC and diamond drilling. Estimated resources include a variance adjustment to give estimates of recoverable resources above gold cut-off grades for selective mining unit dimensions of 5m east by 10m north by 5m in elevation.

The Inferred Mineral Resource estimate has been classified and reported in accordance with NI 43-101 and classifications adopted by CIM Council in May 2014. They have an effective date of the January 27, 2021.

The estimates are based RC and diamond drilling data supplied by Montage in January 2021.

Micromine software was used for data compilation, domain wire framing and coding of composite values and GS3M was used for resource estimation. The resulting estimates were imported into Micromine for resource reporting.

Inferred Mineral Resources have been estimated within a single mineralized envelope sub-divided into northern and southern domains reflecting the differing tenor of gold grades in the two areas. The mineralized envelope is 2.4km in length and up to 350 m in true width.

The estimates are classified as Inferred, primarily reflecting the drill hole spacing of 50m by 100m and extend to depths of up to 460m.

The estimates include bulk densities of 1.6, 2.4 and 2.8 t/bcm for oxide, transition and fresh mineralization respectively on the basis of 1,864 immersion density measurements performed by the Company on diamond core samples.

The Inferred Mineral Resource estimate was constrained by preliminary pit optimizations generated in Micromine to satisfy the definition of Mineral Resources having reasonable prospects for eventual economic extraction, and are based on the following parameters:

- Gold price of US$1,500/oz

- The MIK Model is a recoverable resource model and mining recovery and dilution are taken into account within the modelling process.

- Processing recovery of 97.8% in oxide, 96.5% in transition material and 91.4% in fresh rock

- Overall slope angle of 35° in oxide rock, 40° in transition and 60° in fresh material

- Average mining costs of US$2.80 per tonne

- Average processing costs (including G&A) of US$8.89 per tonne

- Total selling costs (includes state and third-party royalties) of US$179/oz

QUALITY ASSURANCE/QUALITY CONTROL

All drilling data completed by Montage utilized the following procedures and methodologies. All drilling was carried out under the supervision of Montage personnel.

RC drilling used a 5.25-inch face sampling pneumatic hammer with samples collected into 60 litre plastic bags. Samples were kept dry by maintaining enough air pressure to exclude groundwater inflow. If water ingress exceeded the air pressure, RC drilling was stopped, and drilling converted to diamond core tails. Once collected, RC samples were riffle split through a three-tier splitter to yield a 12.5% representative sample for submission to the analytical laboratory. The residual 87.5% sample was stored at the drill site until assay results were received and validated. Coarse reject samples for all mineralized samples corresponding to significant intervals are retained and stored on-site at the Company controlled core yard.

Diamond drill holes were drilled with PQ and HQ diamond drill bits. The core marked up and logged, and samples (minimum 0.5m) were then cut into equal halves using a diamond saw. One half of the core was left in the original core box and stored in a secure location at the Company core yard at Fadiadougou. The other half was sampled, catalogued, and placed into sealed bags and securely stored at the site until shipment.

All samples for the period 2017-2018 were shipped to the Intertek Laboratory in Tarkwa, Ghana and Bureau Veritas Laboratory in Abidjan for preparation and assay. All samples for the period 2019 to 2020 were shipped to the Bureau Veritas Laboratory. Both Intertek and Bureau Veritas are independent of Montage.

At both laboratories, samples were dried and crushed by the laboratory to -2mm and a 1.5kg split prepared from the coarse crushed material for pulverizing to -75um. Gold analysis was undertaken using a 50-gram charge and fire assay with an atomic absorption finish. Quality control procedures included systematic insertion of blanks, duplicates and sample standards into the sample stream.

For more information on the Company’s QA/QC and sampling procedures, please refer to: Refer to SEDAR for NI 43-101 Technical Report entitled “Amended and Restated Technical Report for the Morondo Gold Project, Côte d’Ivoire”.

The Company will file an NI 43-101 Technical Report on the updated Inferred Mineral Resource estimate within 45 days of this release.

QUALIFIED PERSONS STATEMENT

The Inferred Mineral Resource estimate was carried out by Mr. Jonathon Abbott of MPR Geological Consultants of Perth, Western Australia who is considered to be independent of Montage Gold. Mr. Abbott is a member in good standing of the Australian Institute of Geoscientists and has sufficient experience which is relevant to the commodity, style of mineralization under consideration and activity which he is undertaking to qualify as a Qualified Person under National Instrument 43-101. Mr. Abbott consents to the inclusion in this press release of the information, in the form and context in which it appears.

The technical contents of this release have been approved by Hugh Stuart, BSc, MSc, a Qualified Person pursuant to National Instrument 43-101. Mr. Stuart is the Chief Executive Officer of the Company, a Chartered Geologist and a Fellow of the Geological Society of London.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS

This press release contains certain forward-looking information and forward-looking statements within the meaning of Canadian securities legislation (collectively, “Forward-looking Statements”). All statements, other than statements of historical fact, constitute Forward-looking Statements. Words such as “will”, “intends”, “proposed” and “expects” or similar expressions are intended to identify Forward-looking Statements. Forward looking Statements in this press release include statements related to the Company’s resource properties, and the Company’s plans, focus and objectives. Forward-looking Statements involve various risks and uncertainties and are based on certain factors and assumptions. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include uncertainties related to fluctuations in gold and other commodity prices, uncertainties inherent in the exploration of mineral properties, the impact and progression of the COVID-19 pandemic and other risk factors set forth in the Company’s final prospectus under the heading “Risk Factors”. The Company undertakes no obligation to update or revise any Forward-looking Statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Montage to predict all of them or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any Forward-looking Statement. Any Forward-looking Statements contained in this press release are expressly qualified in their entirety by this cautionary statement.