Montage Successfully Upgrades Mineral Resources at Gbongogo Main; Total Indicated Mineral Resources at Koné Gold Project Approach 5 Million Ounces

September 7, 2023

Vancouver, British Columbia — September 7, 2023 — Montage Gold Corp. (“Montage” or the “Company”) (TSXV: MAU) (OTCQX: MAUTF) is pleased to report an updated Mineral Resource Estimate (“MRE”) for the Company’s Koné Gold Project (“KGP”) in Côte d’Ivoire. The update represents the first Indicated Mineral Resource at Gbongogo Main of 12.0Mt grading 1.45g/t for 559koz (at a 0.50 g/t cut-off grade, the “September 2023 Gbongogo Main MRE”). The Company is also pleased to update its shareholders on initiatives to progress the KGP towards a development decision in early 2024.

Highlights

- Recent drilling at Gbongogo Main achieves a high level of resource conversion from Inferred to Indicated and sees an increase in grade

- Indicated Mineral Resource of 12.0Mt grading 1.45g/t for 559koz (at 0.50 g/t cut-off grade)

- Grade improves by +10% over April 2022 Gbongogo Main MRE

- Anticipated strong positive impact on KGP production profile and economics

- Further drill testing of high-grade veins at Gbongogo Main expected to increase deposit grade even more

- Feasibility-level metallurgical testing returns positive results

- Total combined Indicated Mineral Resources at Koné Gold Project grow to 4.83Moz plus additional Inferred Mineral Resources of 0.32Moz (see Table 3 for disclosure)

- Montage strengthens management team with addition of Mike Robinson as Côte d’Ivoire Country Manager

- Former Country Manager for Red Back Mining in Mauritania; oversaw development and expansion of Tasiast Project

- Over 40 years of experience in mining operations management, engineering, maintenance and administration

- Montage continues to advance and de-risk the KGP

- Permitting activities have been ongoing over last several months

- Formal submission of ESIA planned for October 2023

- Updated DFS targeted for release by year-end 2023

- Project finance discussions have commenced

- Corporate headquarters established in Toronto

- Multiple targets within KGP identified for future exploration

Rick Clark, Montage CEO commented, “The upgrade of the Gbongogo Main deposit is a significant milestone for Montage and the KGP, with Indicated Mineral Resources now nearly 5 million ounces across the project. We are very pleased with the successful conversion of Gbongogo Main resources from Inferred to Indicated and the 10% increase in grade and that has the potential to translate well into the current feasibility study. With further testing of the high-grade quartz tourmaline vein sets that characterize the deposit planned we are confident that we can add further high-grade ounces to the deposit.

“With the initial conversion of Gbongogo Main now completed, we are on track to make a construction decision for the KGP. The formal permitting process will begin in Q4 2023 with the submission of the ESIA and we are confident that the project will be fully permitted during the first half of 2024. An updated DFS is on track and is expected to be completed by the end of 2023 and will incorporate additional reserves from Gbongogo Main.

“From an operations perspective we are very excited to have Mike Robinson join our management team in charge of the in-country operations and development of KGP. Mike, together with other former development and operations management from Red Back, will be the backbone of our business plan for KGP and Côte d’Ivoire. Our track record speaks for itself.”

Details

Updated Mineral Resource Estimate for Gbongogo Main

The September 2023 Gbongogo Main MRE was undertaken by Matrix Resource Consultants of Perth, Australia (“Matrix”) who estimated recoverable mineral resources using Multiple Indicator Kriging (“MIK”).

Relative to information available for the April 2022 Gbongogo Main MRE, th current dataset includes information for drill holes totalling an additional 12,246.9m (7,329.9m of core and 4,917.0m of reverse circulation (“RC”)) giving a total of 18,389.3m (12,157.3m of core and 6,232.0m of RC) on which this new estimate has been based.

The September 2023 Gbongogo Main MRE is reported within an optimal pit shell based on a US$1,500/oz gold price and is shown below at a range of cut-off grades (Table 1). A cut-off grade of 0.50 g/t is the preferred scenario based on preliminary estimates of mining and haulage costs to the proposed Koné process plant and estimates of metallurgical recoveries and process costs.

Table 1: September 2023 Gbongogo Main MRE by Cut-off Grade

| Cut-off Grade | Indicated | Inferred | ||||

| Au g/t | Mt | Au g/t | Au Koz | Mt | Au g/t | Au Koz |

| 0.1 | 20.9 | 0.94 | 632 | 1.1 | 0.23 | 8.1 |

| 0.2 | 16.8 | 1.13 | 610 | 0.26 | 0.52 | 4.3 |

| 0.3 | 15.1 | 1.23 | 597 | 0.18 | 0.64 | 3.7 |

| 0.4 | 13.5 | 1.33 | 577 | 0.13 | 0.77 | 3.2 |

| 0.5 | 12.0 | 1.45 | 559 | 0.09 | 0.89 | 2.6 |

| 0.6 | 10.6 | 1.56 | 532 | 0.07 | 1.0 | 2.3 |

| 0.7 | 9.30 | 1.69 | 505 | 0.05 | 1.1 | 1.8 |

| 0.8 | 8.20 | 1.82 | 480 | 0.04 | 1.2 | 1.5 |

| 0.9 | 7.20 | 1.95 | 451 | 0.03 | 1.4 | 1.4 |

| 1.0 | 6.40 | 2.08 | 428 | 0.02 | 1.5 | 1.1 |

| 1.2 | 5.00 | 2.34 | 376 | - | - | - |

| 1.4 | 4.00 | 2.60 | 334 | - | - | - |

Notes

1. Rounding errors are apparent.

2. The updated Mineral Resources are reported in accordance with NI 43-101 with an effective date of the 7th September 2023, for the Gbongogo Main deposit within the Koné Gold Project.

3. The MRE is reported on a 100% basis and is constrained within an optimal pit shell generated at a gold price of US$1,500/ounce.

4. The identified Mineral Resources are classified according to the “CIM” definitions of Inferred Mineral Resources.

5. This Mineral Resource Estimate was prepared by Mr. Jonathon Abbott of Matrix Resource Consultants of Perth, Australia who is a Qualified Person as defined by NI 43-101.

6. The estimates at 0.50g/t cut-off grade represent the base case or preferred scenario.

7. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Table 2 shows a comparison of the September 2023 Gbongogo Main MRE against the April 2022 Gbongogo Main MRE across a range of cut-off grades to demonstrate conversion of Mineral Resources from Inferred to Indicated and to illustrate the change in tonnage, grade, and ounces.

As can be seen from the Table infill drilling has succeeded in defining +99% Indicated resources within the resource reporting pit and has resulted in an increase in resource grade of approximately 10% across a range of cut-off grades.

Table 2: Comparison of September 2023 Gbongogo Main MRE to April 2022 Gbongogo Main MRE

| Cut-off Grade | September 2023 Gbongogo Main MRE | April 2022 Gbongogo Main MRE | |||||||

| Indicated Mineral Resource | Inferred Mineral Resource | Inferred Mineral Resource | |||||||

| Au g/t | Mt | Au g/t | Au Koz | Mt | Au g/t | Au Koz | Mt | Au g/t | Au Koz |

| 0.4 | 13.5 | 1.33 | 577 | 0.13 | 0.77 | 3.2 | 15.0 | 1.20 | 579 |

| 0.5 | 12.0 | 1.45 | 559 | 0.09 | 0.89 | 2.6 | 13.2 | 1.29 | 549 |

| 0.6 | 10.6 | 1.56 | 532 | 0.07 | 1.0 | 2.3 | 11.0 | 1.40 | 495 |

| 0.8 | 8.20 | 1.82 | 480 | 0.04 | 1.2 | 1.5 | 8.8 | 1.60 | 453 |

| 1.0 | 6.40 | 2.08 | 428 | 0.02 | 1.5 | 1.1 | 6.7 | 1.80 | 388 |

| 1.2 | 5.00 | 2.34 | 376 | - | - | - | 5.2 | 2.10 | 351 |

Notes:

1. See Table 1 for disclosures relating to the September 2023 Gbongogo Main MRE.

Combined Indicated Mineral Resources at KGP grows to nearly 5 million ounces

On a combined basis (Table 3) the KGP now hosts total Indicated Mineral Resources of 4.83Moz and additional Inferred Mineral Resources of 0.32Moz.

Table 3: Combined Mineral Resources at Koné Gold Project

| Deposit | Cut-off Grade | Indicated Mineral Resource | Inferred Mineral Resource | ||||

| Au g/t | Mt | Au g/t | Au Moz | Mt | Au g/t | Au Moz | |

| Koné | 0.2 | 225 | 0.59 | 4.27 | 22 | 0.45 | 0.32 |

| Gbongogo Main | 0.5 | 12 | 1.45 | 0.56 | - | - | - |

| KGP Total | 237 | 0.63 | 4.83 | 22 | 0.45 | 0.32 | |

Notes:

1. See Table 1 for disclosures relating to the September 2023 Gbongogo Main MRE.

2. Inferred Mineral Resources for September 2023 Gbongogo Main MRE are not shown in the above table due to rounding

3. See press release dated August 19, 2021 for disclosures relating to the Koné deposit Mineral Resource Estimate (the “August 2021 Koné Deposit MRE”)

High grade vein sets to be further defined

High grades at Gbongogo Main are controlled by a stockwork of largely irregular, generally thin, quartz-tourmaline veins. With the systematic approach taken by Montage, drilling has now intersected a number of wider, better developed veins. Drill results that have intersected these vein sets are shown in Table 4 below and include new results from holes GBDDH044 and GBDDH045 from the end of the recent drill program.

Table 4: Intercepts from High-Grade Quartz-Tourmaline Vein Sets

| Hole | From (m) | To (m) | Length (m) | Uncut Grade (Au g/t) |

Grade Cut to 20 g/t (Au g/t) |

| GBRC013 | 61.00 | 77.00 | 16.00 | 10.00 | 6.16 |

| GBDDH004 | 85.40 | 95.20 | 9.80 | 10.77 | 8.38 |

| GBDDH007 | 61.20 | 78.10 | 16.90 | 10.60 | 5.00 |

| GBDDH035 | 168.00 | 172.00 | 4.00 | 17.59 | 12.16 |

| GBDDH039 | 172.50 | 195.00 | 20.50 | 10.95 | 8.34 |

| GBDDH043 | 197.00 | 214.00 | 17.00 | 8.56 | 5.35 |

| GBDDH044 | 233.00 | 241.00 | 8.00 | 15.71 | 5.57 |

| GBDDH045 | 238.50 | 255.00 | 16.50 | 10.69 | 3.10 |

| GBRC024 | 51.00 | 64.00 | 13.00 | 9.75 | 8.84 |

Note: Intercepts are 60-80% of true width

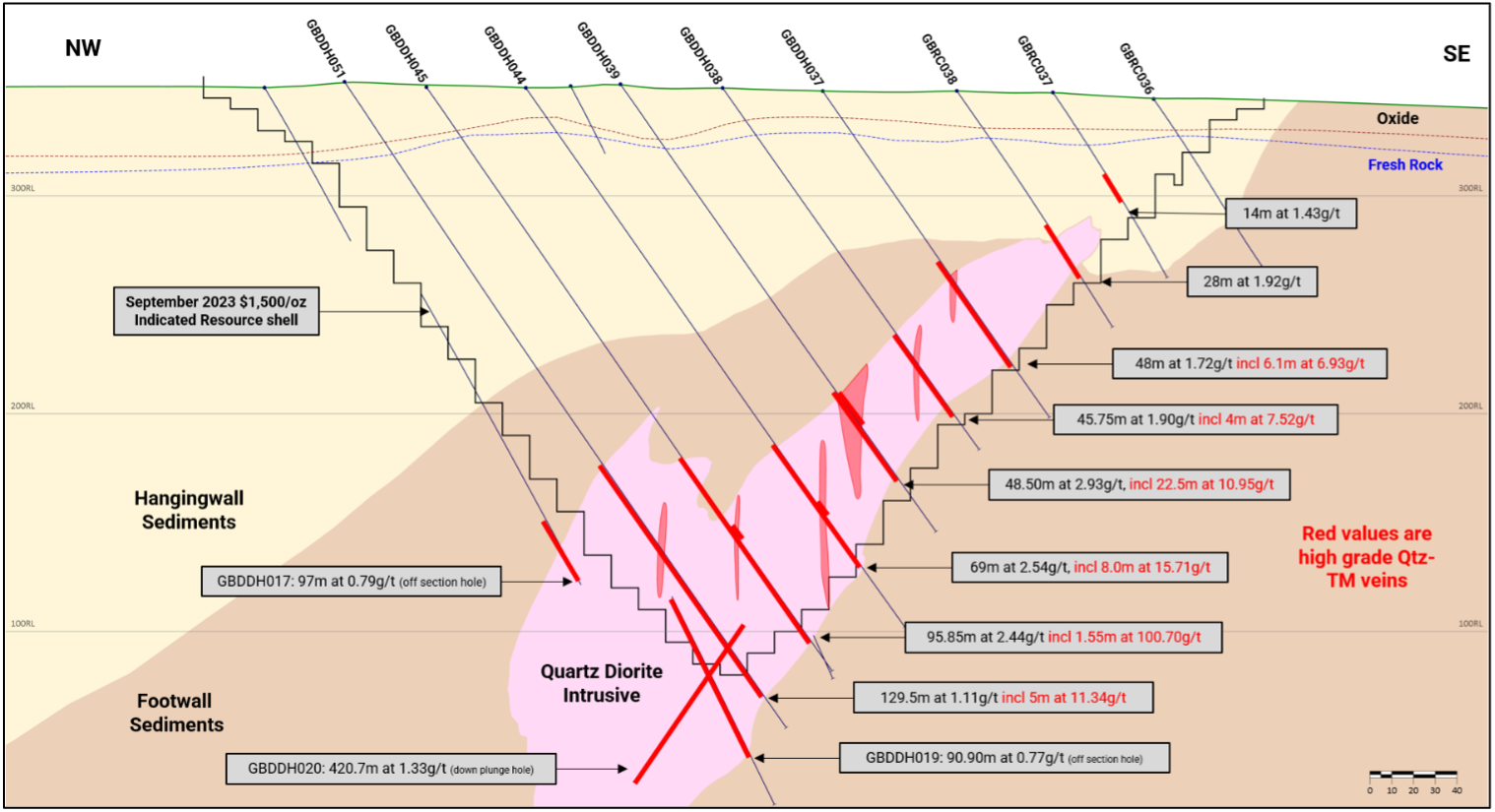

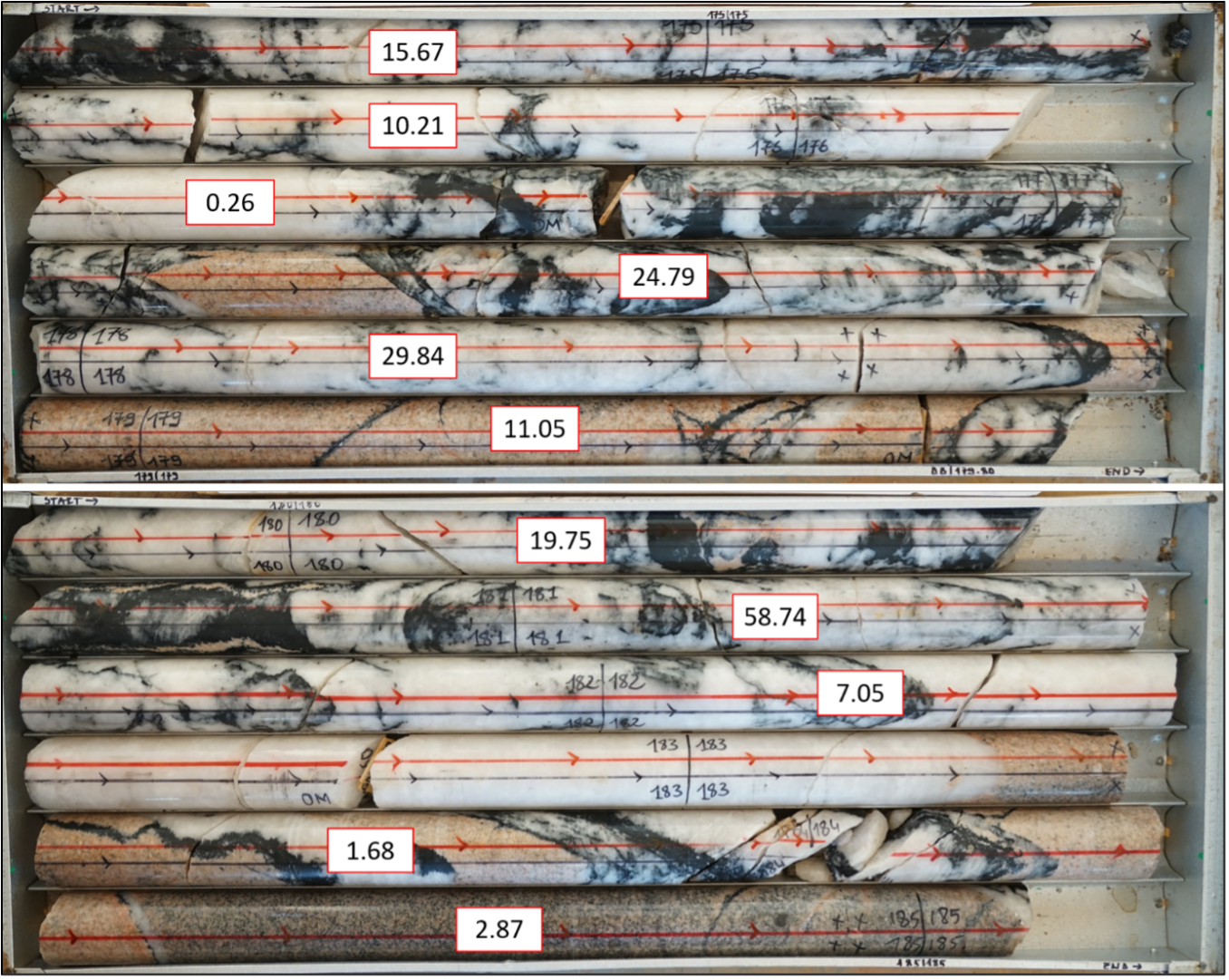

The infill drilling program has provided significantly more structural information on these veins and there is now enough drill coverage to get an understanding of orientation and control. Of particular interest is the discovery of several larger veins which have returned some of the more spectacular intercepts at Gbongogo Main (see GBDDH039 in Figure 1 and Figure 2). These vein systems, particularly the larger veins, offer the potential to further increase the grade profile at Gbongogo Main.

Figure 1: Cross Section of Gbongogo Main with High-Grade Quartz Tourmaline Intercepts Highlighted

Figure 2: High Grade quartz tourmaline veins in GBDDH039 with gold grade in g/t (1m samples)

Figure 2: High Grade quartz tourmaline veins in GBDDH039 with gold grade in g/t (1m samples)

Feasibility-level metallurgical program at Gbongogo Main returns positive results

A metallurgical testwork program was carried out by SGS Lakefield on 16 leach optimization and 10 comminution variability samples representing a range of material and rock types from the Gbongogo Main deposit.

The testwork program applied the same conditions as for the Koné deposit (grind size P80 75µm) and demonstrated that Gbongogo Main is amenable to direct tank carbon in pulp cyanide leaching with good gold recoveries, low reagent consumptions and medium/low resistance to grinding, providing favourable processing economics and a simple flowsheet. The important conclusion from the testwork program is that the flowsheet design already contemplated in the original KGP DFS is appropriate for the Gbongogo Main mineralization.

Table 5 shows the average gold recoveries and reagent consumptions at the tested grades. Average gold recoveries include a solution loss of 0.005mg/l gold and carbon fines loss of 0.15%.

Cyanide consumption is low to very low and lime consumption is low for the dominant fresh material, but higher for the less dominant transition and oxide zones.

Table 5 – Metallurgical Testwork Summary

| Domain | Samples Tested | Average Tested g/t Au | Average Recovery (%) |

Cyanide Consumption (kg/t) |

Lime Consumption (kg/t) |

| GB Fresh | 8 | 1.54 | 86.6 | 0.42 | 0.55 |

| GB Transition | 4 | 1.61 | 91.3 | 0.21 | 1.06 |

| GB Oxide | 4 | 2.40 | 94.7 | 0.29 | 2.60 |

Montage strengthens management team with addition of Mike Robinson as Country Manager

As part of the strategy to position the Company for the development and operation of the KGP, Montage is expanding its management team. Mike Robinson will be the Company’s Country Manager in Côte d’Ivoire.

Mr. Robinson has 40 years of experience in mining operations management, engineering, maintenance and administration, with over 20 years working in Africa in senior management roles in Ghana, Tanzania and Mauritania.

Notably, Mr. Robinson was part of the Red Back Mining management team from 2004 to 2010, performing in several roles including as Country Manager, Mauritania, where he played a critical role in the successful development, operation and expansion of the Tasiast Gold Mine.

In his role with Montage, Mr. Robinson will reside in Abidjan and oversee all aspects relating to the operations of the Company in Côte d’Ivoire. His initial undertaking will be to expand Montage’s corporate and development presence in Abidjan, through building out finance, accounting, engineering, permitting and government relations functions.

Montage continues to advance and de-risk the KGP towards a construction decision

Permitting Update

In parallel with Montage’s 2023 exploration and resource definition campaigns, the Company has been advancing towards the formal submission of the Environmental & Social Impact Assessment (“ESIA”) for the expanded KGP. Baseline data collection and analysis has been completed for the inclusion of Gbongogo Main and the Company anticipates submitting the ESIA in October 2023.

Over the past several months the Company has been engaging with the various government ministries that will be involved in the permitting process for the KGP, including the Ministry of Water and Forests and the Ministry of Mines, Petroleum and Energy, as well as with consultants and advisors that will be involved in the formal permitting review. Management is confident that the KGP can be permitted in a timely manner based on the continued strong support for the project at all levels of government.

Updated DFS

Significant progress has been made towards the completion of an updated DFS that incorporates Gbongogo Main into the mine plan for the KGP. Montage’s priority is to optimize the project by taking advantage of the higher-grade material at Gbongogo Main early in the project life to enhance overall project economics and to optimize capital payback. Management anticipates the release of the updated DFS by year-end 2023.

Project Finance

Montage has retained HCF International Advisors Ltd. (“HCF”) to advise in the raising of project finance for the development of the KGP (see press release dated March 9, 2022). A formal solicitation process is expected to commence in Q4 2023. The Company intends to engage with a broad range of financiers, including multi-national commercial banks, African commercial banks, private debt funds, private equity funds as well as streaming and royalty companies. Based on expectations around permitting timing and the release of the updated DFS, the Company looks to announce project financing in 2024.

Establishing Headquarters in Toronto

To support the corporate development, administrative, financing and legal requirements necessary to advance the KGP through construction and operations and to better accommodate stakeholder relations, Montage has opened a corporate head office in Toronto.

Multiple targets within KGP identified for future exploration

In late 2022 Montage began its first district exploration program on the expanded KGP project area which now covers 1,800 sq km, all of which is within haulage distance of the Koné orebody. A total of 20 target areas were tested with a variety of exploration methods including soil sampling, shallow reconnaissance drilling, RC drilling, and ground geophysics (see Figure 3).

Figure 3: KGP Project Area with Exploration Target Highlight Results

Figure 3: KGP Project Area with Exploration Target Highlight Results

The priorities for the next phase of exploration will be the Yeré North target where RC drilling intersected 23m at 12.91g/t YERNRC010 and the Diouma-Gbongogo-Korotou shear zone. This extensive target area extends for 14km and hosts the Gbongogo Main resource, large scale gold in soil anomalies and extensive artisanal workings in an area where any resources defined will benefit from the dedicated haul road and associated infrastructure that will be part of the development of the Gbongogo Main deposit.

The Company has recently completed an induced polarisation (“IP”) and ground magnetic survey over this trend and Yeré North and follow up of the Diouma, Gbongogo North and South, Sena, Koban and Korotou targets will commence at the end of the wet season. Several other prospects will also receive follow up in due course and represent opportunities to define further satellite resources that can contribute to production from the KGP.

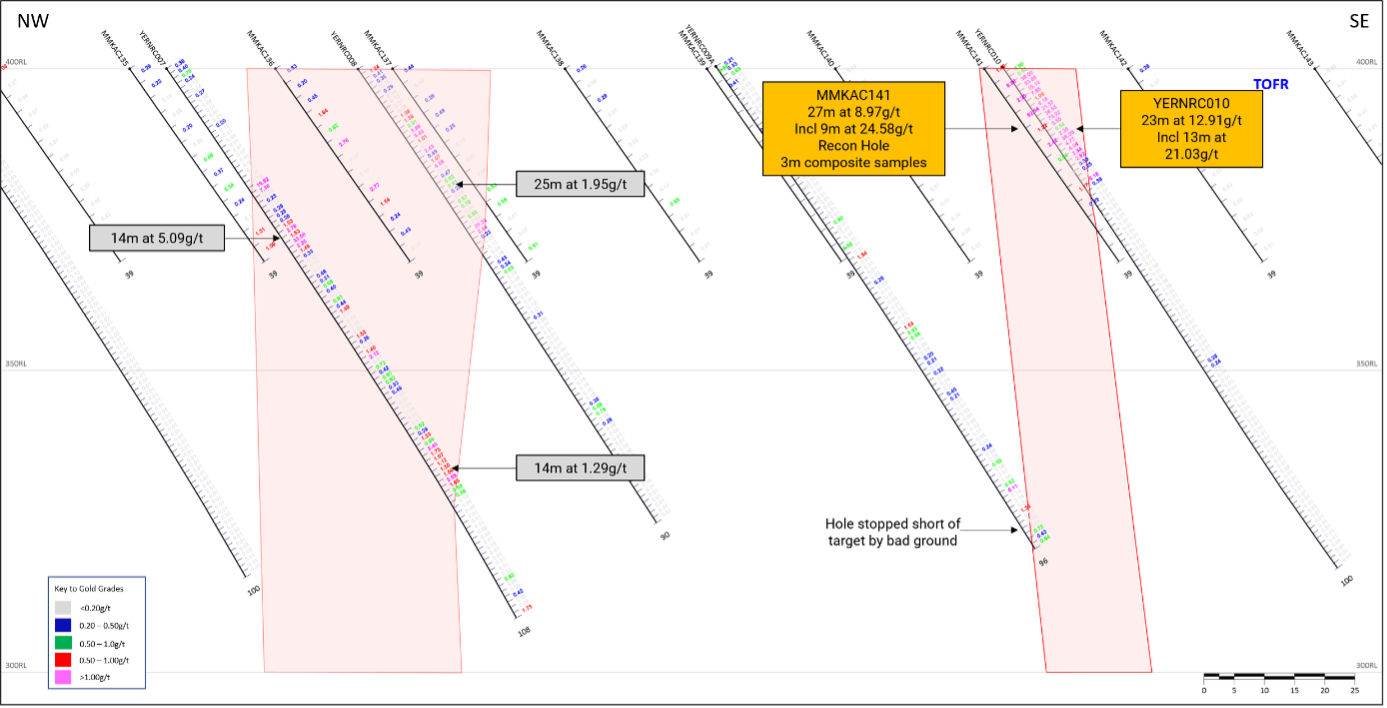

Yeré North: Following a successful reconnaissance program, Montage completed seven RC holes (842m) at Yere North. This drilling confirmed mineralisation on all sections, most notably to the south where two zones of mineralisation were identified. A high-grade reconnaissance drilling intercept (hole MMKAC141, 3m composite samples) was twinned for confirmation with 1m samples and returned a significantly better intercept, in hole YERNRC010, of 23m at 12.91g/t (incl. 13m at 21.03g/t) relative to the earlier 27m at 8.97g/t (incl. 9m at 24.58g/t).

Figure 4: Yeré North Cross Section (looking north-east)

Figure 4: Yeré North Cross Section (looking north-east)

An IP survey has now been completed over the area to better understand geology and structure. A priority follow-up drill program will commence at the end of the wet season.

Petit Yao: Drilling in 2020 and 2021 identified bedrock mineralisation over a strike length of 500m including intercepts of 12m of 4.15g/t, 15m at 1.71g/t and 6m of 10.82g/t (MRCAC128, MRCAC118 and MRPYRC030A).

Lokolo North: Montage completed 5 RC drill holes in an area with active artisanal mining. Highlight intercepts include 13m at 1.75g/t and 20m at 1.74g/t (LOKRC020 and LOKRC021).

Sissédougou: Montage completed 4 lines of shallow RC drilling north of historic drilling to test for extensions of mineralization. Intercepts at the end of two lines intersected good grades and widths over a strike length of 400m, including: 15m at 1.02g/t, 30m at 1.28g/t and 24m at 1.11g/t (MMKAC529, MMKAC530 and MMKAC542).

Niondje: Montage completed a single line of shallow RC drilling across a strong soil anomaly (+100ppb) and intersected mineralization close to surface, with results of 9m at 1.41 g/t and 9m at 1.96g/t (MMKAC794 and MMKAC795).

Bafritou: This target area sits within a large soil anomaly on strike and 6km north of the Koné orebody with an historic aircore intercept of 17m at 3.28g/t (BFSAC106). This result has seen no follow-up work to date.

TZ_2: Montage completed five lines of shallow RC drilling across a large +100ppb soil anomaly, intersecting good grades and widths over a strike length of 450m, including: 12m at 3.75g/t, 15m at 1.98g/t, 9m at 2.36g/t and 6m at 2.82g/t (MOCAC099, MOCAC113, MOCAC114, and MOCAC109).

ABOUT MONTAGE GOLD CORP.

Montage is a Canadian-based precious metals exploration and development company focused on opportunities in Côte d’Ivoire. The Company’s flagship property is the Koné Gold Project (“KGP”), located in northwest Côte d’Ivoire, covering a total area of 2,258km2 and which now hosts an Indicated Mineral Resource of 4.83M ounces of gold, plus an Inferred Mineral Resource of 0.32M ounces. The Company released the results of a Definitive Feasibility Study on the KGP on February 14, 2022, which included a Probable Mineral Reserve of 161.1Mt grading 0.66g/t for 3.42M ounces of gold, supporting a 15-year gold project producing an estimated 3.06M ounces of gold over life of mine, with average annual production of 207koz, and estimated peak production of 320koz. The Company is looking to deliver an Updated Definitive Feasibility Study by year end 2023 which will incorporate the new Indicated Mineral Resource from Gbongogo Main.

In addition to the growing resource and reserve base at the KGP, the Company has an extensive exploration target pipeline all sitting within trucking distance of the planned central milling facility that positions the KGP for significant long-term upside.

Montage is progressing the KGP towards a development decision in early 2024 with permitting and project financing activities commencing in Q4 2023. Montage has a management team and Board with significant experience in discovering and developing gold deposits in Africa, including the successful sale of Red Back Mining Inc. and Orca Gold Inc.

GBONGOGO MAIN MINERAL RESOURCE MODELING AND ESTIMATION ASSUMPTIONS

The September 2023 MRE for the Gbongogo Main deposit was undertaken by Mr. Jonathon Abbott of Matrix Resource Consultants of Perth, Australia (“Matrix”) who is considered to be independent of Montage Gold. Mr. Abbott is a member in good standing of the Australian Institute of Geoscientists and has sufficient experience which is relevant to the commodity, style of mineralization under consideration and activity which he is undertaking to qualify as a Qualified Person under National Instrument 43-101 (“NI 43-101”). Mr. Abbott consents to the inclusion in this press release of the information, in the form and context in which it appears.

Recoverable resources were estimated for Gbongogo Main by Multiple Indicator Kriging (“MIK”) of two metre down-hole composited gold grades based on a dataset that includes 18,389.3 m of drilling (12,157.3 m of core and 6,232.0 m of RC). Estimated resources include a variance adjustment to give estimates of recoverable resources above gold cut-off grades for selective mining unit dimensions of 5m by 10m by 5m (cross strike, strike, vertical).

The September 2023 Gbongogo Main MRE has been classified and reported in accordance with NI 43-101 and classifications adopted by CIM Council in May 2014 and has an effective date of the 7th of September 2023.

The MRE is based on two metre down-hole composited gold assay grades from RC and diamond drilling data supplied by Montage in August 2023.

Micromine software was used for data compilation, domain wire framing and coding of composite values and GS3M was used for resource estimation. The resulting estimates were imported into Micromine for pit optimization and resource reporting.

The resource modelling included a mineralized envelope, which, strikes northeast over around 700 metres and dips to the west at around 55o. The mineralized envelope is subdivided into a hangingwall domain of generally low gold grades, and a higher-grade footwall domain. The footwall domain was further subdivided into northern and southern zones which are comparatively higher and lower grade respectively.

Wire-framed surfaces representing the base of complete oxidation and top of fresh rock interpreted by Montage geologists from drill hole logging were used for density assignment and portioning the estimates by oxidation type. With the general resource area, the base of complete oxidation averages around 24 m below surface, and transitional material ranges averages around 8 m thick with fresh rock occurring at an average depth of around 32 m.

The September 2023 Gbongogo Main MRE includes bulk densities of 1.65, 2.55 and 2.70 t/bcm for oxide, transition and fresh material respectively on the basis of 1,287 immersion density measurements of diamond core samples, comprising 905 measurements performed by the Barrick/Endeavour and 382 measurements performed the Company respectively.

To satisfy the definition of Mineral Resources having reasonable prospects for eventual economic extraction, the estimates are constrained within an optimal pit and generated from the following key parameters:

- Gold price of US$1,500/oz

- The MIK Model is a recoverable resource model and mining recovery and dilution are taken into account within the modelling process

- Processing recovery of 91.8% in oxide, 91.2% in transition material and 91.1% in fresh rock on the basis of metallurgical testwork by SGS Lakefield.

- Overall slope angles of 30° in oxide rock, 40° in transition and 55° in fresh material

- Average mining costs of US$2.54 per tonne

- Processing costs (including G&A) of US$7.82, US$8.11 and US$8.67 for oxide, transition and fresh material respectively based on an updated estimate of costs for the Koné deposit

- Haulage costs of US$3.50/t

- Total selling costs (includes state and third-party royalties) of US$102.21/oz

The pit shell constraining the estimates extends over approximately 610 m of strike to a maximum depth of around 285m.

TECHNICAL DISCLOSURE – KONÉ DEPOSIT

The Mineral Reserve Estimate for the Koné Deposit has an effective date of February 14, 2022 and was carried out by Ms. Joeline McGrath of Carci Mining Consultants Ltd. who is considered to be independent of Montage. Ms. McGrath is a member in good standing of the Australian Institute of Mining and Metallurgy and has sufficient experience which is relevant to the work which she is undertaking to qualify as a Qualified Person under NI 43-101.

The Mineral Resource Estimates for the Koné Deposit have an effective date of August 12, 2021 and were carried out by Mr. Jonathon Abbott of Matrix who is considered to be independent of Montage Gold. Mr. Abbott is a member in good standing of the Australian Institute of Geoscientists and has sufficient experience which is relevant to the commodity, style of mineralization under consideration and activity which he is undertaking to qualify as a Qualified Person under NI 43-101.

For further details of the data verification undertaken, exploration undertaken and associated QA/QC programs, and the interpretation thereof, and the assumptions, parameters and methods used to develop the Mineral Reserve Estimate and the Mineral Resource Estimates for the Koné Gold deposit, please see the definitive feasibility study, entitled "Koné Gold Project, Côte d'Ivoire Definitive Feasibility Study National Instrument 43-101 Technical Report" (the “DFS”) and filed on SEDAR at www.sedar.com. The DFS was prepared by Lycopodium Minerals Pty Ltd. and incorporates the work of Lycopodium and Specialist Consultants, including Mr. Abbott, under the supervision of Sandy Hunter, MAusIMM (CP), of Lycopodium, a Qualified Person pursuant to NI 43-101 who is independent of Montage. Readers are encouraged to read the DFS in its entirety, including all qualifications, assumptions and exclusions that relate to the details summarized in this news release. The DFS is intended to be read as a whole, and sections should not be read or relied upon out of context.

TECHNICAL DISCLOSURE – SAMPLING AND ASSAYING

Samples used for the results described have been prepared and analysed by fire assay using a 50-gram charge at the Bureau Veritas facility in Abidjan, Côte d’Ivoire or the SGS facility in Yamoussoukro, Côte d’Ivoire. Shallow RC reconnaissance results are based on 3 metre composite samples. Field duplicate samples are taken, and blanks and standards are added to every batch submitted. QAQC has been approved in line with industry standards and interpretations reviewed the Qualified Person.

The technical contents of this press release have been approved by Hugh Stuart, BSc, MSc, a Qualified Person pursuant to NI 43-101. Mr. Stuart is the President of the Company, a Chartered Geologist and a Fellow of the Geological Society of London.

CONTACT INFORMATION

| Hugh Stuart President hstuart@montagegoldcorp.com |

Adam Spencer Executive Vice President, Corporate Development aspencer@montagegoldcorp.com mobile: +1 (416) 804-9032 |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS

This press release contains certain forward-looking information and forward-looking statements within the meaning of Canadian securities legislation (collectively, “Forward-looking Statements”). All statements, other than statements of historical fact, constitute Forward-looking Statements. Words such as “will”, “intends”, “proposed” and “expects” or similar expressions are intended to identify Forward-looking Statements. Forward-looking Statements in this press release include statements related to the Company’s resource properties and resource estimates, and the Company’s plans, focus and objectives, including its exploration objectives and future exploration programs at the KGP, expectations that the Gbongogo Main deposit Inferred Mineral Resource will become an Indicated Mineral Resource, expectations that the KGP will be improved and that additional higher grade resources will be added, the details regarding the conceptual exploration targets for the KGP, and timing for an updated technical report. Forward-looking Statements involve various risks and uncertainties and are based on certain factors and assumptions, including, with respect to mineral resource estimates, those set out in the DFS and those set out under the heading “Mineral Resource Modeling and Estimation Assumptions – Gbongogo” in the press release titled “Montage Gold Corp. Announces Government Approval of Mankono Exploration Permits and Provides Corporate Updates” dated September 8, 2022 and filed on the Company’s SEDAR profile at www.sedar.com. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include uncertainties related to gold and other commodity prices, including lower than expected future gold prices which could reduce the economic returns on, or the viability of, a deposit, uncertainties inherent in the exploration of mineral properties such as incorrect resource estimates due to incorrect modelling or unforeseen geological conditions, the impact and progression of the COVID-19 pandemic and other risk factors set forth in the Company’s annual information form under the heading “Risk Factors”. The Company undertakes no obligation to update or revise any Forward-looking Statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Montage to predict all of them, or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any Forward-looking Statement. Any Forward-looking Statements contained in this press release are expressly qualified in their entirety by this cautionary statement.

Appendix 1: Listing of Intercept Detail

Note: For Gbongogo Main, the bolded interval represents the complete intercept, with sub-intervals reported below it.

| Prospect | Hole ID | Drill Type | Collar Location (UTM Zone 29N) |

Orientation | Depth | From

(m) |

To

(m) |

Length

(m) |

Uncut

Au (g/t) |

Grade Cut to 20g/t

(g/t) |

|||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| mE | mN | mRL | Dip | Azim | |||||||||

| Gbongogo Main | GBDDH044 | Core | 769,252 | 993,733 | 350 | -55 | 141 | 302.70 | 198.00 | 267.00 | 69.00 | 2.54 | 1.36 |

| 198.00 | 203.00 | 5.00 | 1.08 | 1.08 | |||||||||

| 206.00 | 215.00 | 9.00 | 0.72 | 0.72 | |||||||||

| 220.00 | 223.00 | 3.00 | 1.72 | 1.72 | |||||||||

| 225.00 | 230.00 | 5.00 | 0.61 | 0.61 | |||||||||

| 233.00 | 241.00 | 8.00 | 15.71 | 5.57 | |||||||||

| 260.00 | 264.00 | 4.00 | 5.16 | 5.16 | |||||||||

| GBDDH045 | Core | 769,224 | 993,769 | 350 | -55 | 142 | 326.70 | 216.00 | 311.85 | 95.85 | 2.44 | 1.14 | |

| 216.00 | 220.50 | 4.50 | 1.26 | 1.26 | |||||||||

| 229.00 | 233.55 | 4.55 | 1.77 | 1.77 | |||||||||

| 238.50 | 255.00 | 16.50 | 10.69 | 3.10 | |||||||||

| 262.00 | 283.00 | 21.00 | 1.15 | 1.15 | |||||||||

| 290.00 | 299.00 | 9.00 | 0.67 | 0.67 | |||||||||

| 302.00 | 311.85 | 9.85 | 0.68 | 0.68 | |||||||||

| GBDDH046 | Core | 769,287 | 993,769 | 350 | -55 | 139 | 275.60 | No significant intercept | |||||

| GBDDH047 | Core | 769,252 | 993,800 | 349 | -56 | 140 | 326.60 | 241.95 | 307.00 | 65.05 | 0.66 | 0.66 | |

| 241.95 | 245.00 | 3.05 | 1.07 | 1.07 | |||||||||

| 248.00 | 265.00 | 17.00 | 0.80 | 0.80 | |||||||||

| 289.00 | 307.00 | 18.00 | 1.04 | 1.04 | |||||||||

| GBDDH048A | Core | 769,118 | 993,738 | 352 | -56 | 139 | 329.60 | 181.00 | 272.00 | 91.00 | 1.07 | 1.07 | |

| 181.00 | 184.00 | 3.00 | 3.69 | 3.69 | |||||||||

| 187.00 | 198.00 | 11.00 | 1.22 | 1.22 | |||||||||

| 202.00 | 205.00 | 3.00 | 1.89 | 1.89 | |||||||||

| 219.00 | 223.00 | 4.00 | 0.86 | 0.86 | |||||||||

| 230.00 | 241.00 | 11.00 | 0.84 | 0.84 | |||||||||

| 246.00 | 261.00 | 15.00 | 2.67 | 2.67 | |||||||||

| 267.00 | 272.00 | 5.00 | 0.68 | 0.68 | |||||||||

| GBDDH049 | Core | 769,154 | 993,776 | 351 | -58 | 142 | 362.50 | 245.00 | 296.00 | 51.00 | 1.07 | 1.07 | |

| 256.00 | 260.00 | 4.00 | 1.29 | 1.29 | |||||||||

| 262.00 | 266.00 | 4.00 | 0.66 | 0.66 | |||||||||

| 270.00 | 288.00 | 18.00 | 2.19 | 2.19 | |||||||||

| GBDDH050 | Core | 769,225 | 993,829 | 350 | -57 | 140 | 371.70 | 285.00 | 359.00 | 74.00 | 0.86 | 0.86 | |

| 285.00 | 297.00 | 12.00 | 1.97 | 1.97 | |||||||||

| 303.00 | 307.00 | 4.00 | 1.20 | 1.20 | |||||||||

| 314.00 | 317.00 | 3.00 | 0.92 | 0.92 | |||||||||

| 320.00 | 327.00 | 7.00 | 1.18 | 1.18 | |||||||||

| 344.00 | 349.00 | 5.00 | 0.73 | 0.73 | |||||||||

| 354.00 | 359.00 | 5.00 | 2.18 | 2.18 | |||||||||

| GBDDH051 | Core | 769,198 | 993,797 | 352 | -57 | 141 | 359.60 | 217.00 | 341.50 | 124.50 | 1.14 | 0.98 | |

| 217.00 | 222.00 | 5.00 | 0.68 | 0.68 | |||||||||

| 233.00 | 242.00 | 9.00 | 2.08 | 2.08 | |||||||||

| 257.00 | 262.00 | 5.00 | 11.34 | 7.36 | |||||||||

| 269.00 | 273.00 | 4.00 | 1.72 | 1.72 | |||||||||

| 277.00 | 280.00 | 3.00 | 1.10 | 1.10 | |||||||||

| 303.00 | 306.00 | 3.00 | 2.89 | 2.89 | |||||||||

| 309.00 | 312.00 | 3.00 | 0.70 | 0.70 | |||||||||

| 317.00 | 321.00 | 4.00 | 1.41 | 1.41 | |||||||||

| 324.00 | 341.50 | 17.50 | 1.14 | 1.14 | |||||||||

| GBDDH052 | Core | 769,315 | 993,736 | 349 | -56 | 140 | 242.60 | 208.00 | 216.55 | 8.55 | 0.92 | 0.92 | |

| GBDDH053 | Core | 769,294 | 993,841 | 349 | -57 | 141 | 329.70 | 251.95 | 260.00 | 8.05 | 0.86 | 0.86 | |

| GBDDH054A | Core | 769,329 | 993,779 | 348 | -59 | 141 | 290.60 | No significant intercept | |||||

| GBDDH055 | Core | 769,349 | 993,693 | 348 | -56 | 141 | 200.60 | No significant intercept | |||||

| GBDDH056 | Core | 769,357 | 993,763 | 348 | -58 | 140 | 239.60 | 23.40 | 35.50 | 12.10 | 1.65 | 1.65 | |

| TZ_2 | MOCAC093 | Recon | 770,079 | 1,024,158 | 419 | -55 | 250 | 39 | 27 | 33 | 6 | 1.65 | 1.65 |

| MOCAC094 | Recon | 770,059 | 1,024,147 | 419 | -55 | 250 | 39 | 18 | 24 | 6 | 1.56 | 1.56 | |

| MOCAC095 | Recon | 770,029 | 1,024,134 | 419 | -55 | 250 | 39 | 0 | 6 | 6 | 1.30 | 1.30 | |

| MOCAC099 | Recon | 769,978 | 1,024,348 | 413 | -55 | 250 | 39 | 24 | 36 | 12 | 3.75 | 3.75 | |

| MOCAC100 | Recon | 769,953 | 1,024,342 | 413 | -55 | 250 | 39 | 15 | 21 | 6 | 1.36 | 1.36 | |

| MOCAC101 | Recon | 769,930 | 1,024,337 | 413 | -55 | 250 | 39 | 0 | 12 | 12 | 0.70 | 0.70 | |

| MOCAC106 | Recon | 769,970 | 1,024,517 | 408 | -55 | 250 | 39 | 30 | 36 | 6 | 1.41 | 1.41 | |

| MOCAC108 | Recon | 769,932 | 1,024,503 | 408 | -55 | 250 | 39 | 18 | 24 | 6 | 0.76 | 0.76 | |

| MOCAC109 | Recon | 769,910 | 1,024,496 | 408 | -55 | 250 | 39 | 12 | 18 | 6 | 2.82 | 2.82 | |

| MOCAC112 | Recon | 769,983 | 1,024,271 | 415 | -55 | 250 | 54 | 15 | 24 | 9 | 1.47 | 1.47 | |

| MOCAC113 | Recon | 769,999 | 1,024,248 | 416 | -55 | 250 | 60 | 9 | 24 | 15 | 1.98 | 1.98 | |

| MOCAC114 | Recon | 770,019 | 1,024,228 | 417 | -55 | 250 | 60 | 15 | 24 | 9 | 2.36 | 2.36 | |

| Sissédougou | MMKAC507 | Recon | 783,456 | 1,015,612 | 439 | -55 | 125 | 39 | 30 | 39 | 9 | 0.46 | 0.46 |

| MMKAC516 | Recon | 783,275 | 1,015,494 | 438 | -55 | 125 | 36 | 12 | 30 | 18 | 0.48 | 0.48 | |

| MMKAC517 | Recon | 783,294 | 1,015,482 | 437 | -55 | 125 | 39 | 12 | 30 | 18 | 0.28 | 0.28 | |

| MMKAC528 | Recon | 783,160 | 1,015,351 | 436 | -55 | 125 | 39 | 21 | 39 | 18 | 0.52 | 0.52 | |

| MMKAC529 | Recon | 783,175 | 1,015,326 | 436 | -55 | 125 | 39 | 12 | 27 | 15 | 1.02 | 1.02 | |

| MMKAC530 | Recon | 783,195 | 1,015,314 | 435 | -55 | 125 | 39 | 9 | 39 | 30 | 1.28 | 1.28 | |

| MMKAC536 | Recon | 782,926 | 1,015,122 | 433 | -55 | 125 | 39 | 3 | 39 | 36 | 0.41 | 0.41 | |

| MMKAC541 | Recon | 783,035 | 1,015,069 | 433 | -55 | 125 | 39 | 27 | 39 | 12 | 0.62 | 0.62 | |

| MMKAC542 | Recon | 783,055 | 1,015,054 | 433 | -55 | 125 | 39 | 9 | 33 | 24 | 1.11 | 1.11 | |

| Korotou | MOCAC158 | Recon | 767,005 | 1,001,962 | 388 | -55 | 90 | 24 | 12 | 24 | 12 | 0.78 | 0.78 |

| MOCAC187 | Recon | 767,014 | 1,002,359 | 394 | -55 | 90 | 18 | 0 | 3 | 3 | 46.60 | 46.60 | |

| MOCAC197 | Recon | 767,126 | 1,002,353 | 396 | -55 | 90 | 24 | 9 | 15 | 6 | 0.64 | 0.64 | |

| MOCAC219 | Recon | 766,383 | 1,001,557 | 376 | -55 | 90 | 36 | 6 | 18 | 12 | 3.15 | 3.15 | |

| Niondje | MMKAC794 | Recon | 772,414 | 982,653 | 317 | -55 | 135 | 30 | 21 | 30 | 9 | 1.41 | 1.41 |

| MMKAC795 | Recon | 772,426 | 982,641 | 316 | -55 | 135 | 24 | 0 | 9 | 9 | 1.96 | 1.96 | |